SaaS accounting services cater to the unique financial needs of software-as-a-service companies, offering virtual CFO services for strategic planning, financial health assessments, and operational efficiency. They provide expertise in revenue recognition, financial reporting, and modeling, essential for accelerating subscription growth and managing key performance indicators. Compliance is paramount in SaaS accounting, ensuring adherence to industry regulations, accurate financial reporting, and transparency to stakeholders, with severe consequences for non-compliance.

Top software solutions like QuickBooks Online, FreshBooks, and Xero offer robust features and user-friendly interfaces to meet diverse business requirements. Expert tips recommend leveraging metrics for growth, financial planning for sustainability, and virtual CFO services for tailor-made assessments, emphasizing streamlining with automated processes and complying with GAAP and investor reporting standards. By exploring further, valuable insights into optimizing financial management strategies can be gained.

Key Takeaways

- Virtual CFO services aid in strategic planning for SaaS businesses.

- Reliable financial guidance ensures operational efficiency.

- Compliance with industry regulations is crucial for avoiding legal issues.

- Top SaaS accounting software solutions include QuickBooks Online and Xero.

- Expert tips recommend leveraging metrics like CAC and LTV for growth optimization.

Benefits of SaaS Accounting Services

SaaS Accounting Services offer a range of benefits tailored to meet the unique financial management needs of startups and SaaS companies. These services provide virtual CFO services for strategic planning, financial health assessments, and reliable financial guidance. They aid in operational efficiency, capital raises, and investor relations.

SaaS accounting services guarantee accurate financial modeling, forecasting, and tax preparation for sustainable growth, supporting the overall financial health of businesses.

Key Features for SaaS Businesses

To optimize their operational performance and financial management, SaaS businesses can leverage key features tailored to their industry-specific needs. These include expertise in revenue recognition, financial reporting, and financial modeling.

Additionally, services assist in accelerating subscription growth, managing essential KPIs, ensuring operational efficiency, recommending tech tools, and providing guidance on tax preparation.

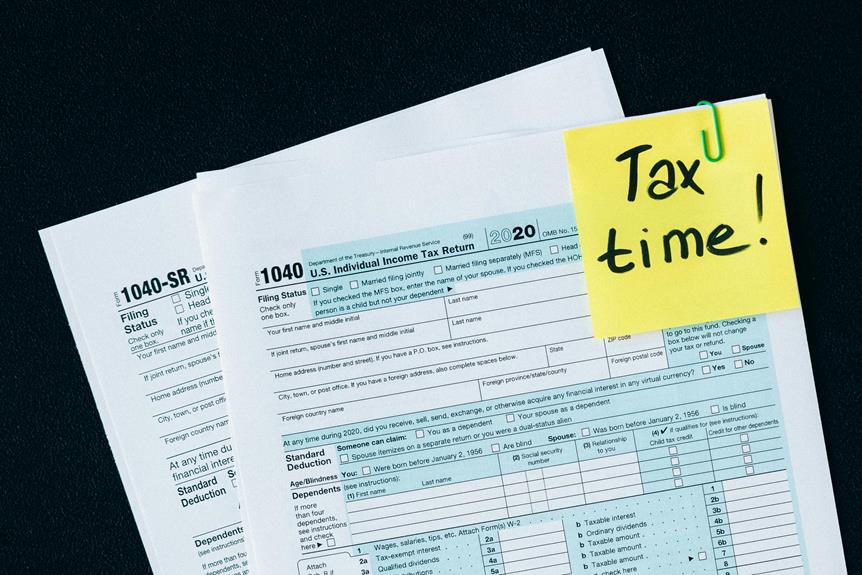

Importance of Compliance in SaaS Accounting

Ensuring regulatory compliance in SaaS accounting is paramount for maintaining trust, transparency, and legal integrity within the industry.

- Adherence to industry regulations and standards.

- Accurate financial reporting and transparency for stakeholders.

- Non-compliance leads to legal issues, fines, and damaged reputation.

- Staying updated on changing compliance requirements is essential to avoid penalties.

Top SaaS Accounting Software Solutions

Among the top SaaS accounting software solutions available in the market, QuickBooks Online, Xero, and FreshBooks stand out for their robust features and user-friendly interfaces catering to the needs of diverse businesses. These platforms offer subscription management, revenue recognition tools, and help small businesses maintain financial health by managing recurring revenue, ensuring GAAP compliance, and providing insights for revenue growth to avoid cash flow problems.

| Feature | SaaS Accounting Software Solutions |

|---|---|

| Subscription Management | QuickBooks Online, FreshBooks |

| Revenue Recognition | Xero, FreshBooks |

| Financial Health | QuickBooks Online, Xero |

Expert Tips for SaaS Financial Management

Building a strong financial foundation in SaaS companies involves implementing expert tips focused on metrics such as CAC and LTV to drive sustainable growth and profitability.

- Leverage Metrics: Focus on CAC and LTV for growth optimization.

- Financial Planning: Utilize modeling and forecasting for revenue sustainability.

- Strategic Support: Seek virtual CFO services for tailored financial assessments.

- Operational Efficiency: Streamline with automated processes, adhering to GAAP and investor reporting standards.

Conclusion

To summarize, SaaS accounting services offer numerous benefits for businesses, including streamlined financial management, enhanced data security, and increased efficiency.

Key features for SaaS businesses include real-time reporting, automated processes, and scalability.

Compliance in SaaS accounting is essential to guarantee adherence to regulations and standards.

Top SaaS accounting software solutions provide extensive tools for financial management.

Following expert tips for SaaS financial management can help businesses optimize their accounting processes and drive growth.